Exhibit 4.7

Subscription Documents

Instructions to Investors

AFTER YOU HAVE DECIDED TO SUBSCRIBE FOR AND PURCHASE THE SERIES B PREFERRED UNITS, PLEASE OBSERVE THESE INSTRUCTIONS:

A. |

Confidential Subscriber Questionnaire |

Complete and sign two originals of the “Confidential Subscriber Questionnaire.” The purpose of the Confidential Subscriber Questionnaire is to provide certain information as to the status of a subscriber to enable the Partnership and the General Partner to determine whether to accept a subscription. It is understood that the information provided is confidential and will not be reviewed by anyone other than the Partnership, the General Partner, and its counsel. |

B. |

Subscription Agreement |

Complete and sign two originals of the “Subscription Agreement.” PLEASE READ THE SUBSCRIPTION AGREEMENT IN ITS ENTIRETY. IT CONTAINS VARIOUS STATEMENTS AND REPRESENTATIONS TO BE MADE BY SUBSCRIBERS, AS WELL AS ADDITIONAL INFORMATION ABOUT THE PARTNERSHIP. |

C. |

Counterpart Signature Page to the Limited Partnership Agreement |

Complete and sign two originals of the counterpart signature page to the Second Amended and Restated Agreement of Limited Partnership of Greystone Housing Impact Investors LP dated December 5, 2022, as amended. |

D. |

Return of Subscription Materials |

All of the foregoing documents must be delivered to:

Greystone Housing Impact Investors LP c/o Greystone AF Manager LLC 14301 FNB Parkway, Suite 211 Omaha, Nebraska 68154 Attention: Jesse A. Coury, CFO

After receipt of all the foregoing completed documents, the General Partner will determine whether to accept the subscription. If the subscription is accepted, the General Partner will notify the prospective investor of the date by which the prospective investor will be required to transmit the amount of such investor’s subscription proceeds, together with instructions for making payment for the Series B Preferred Units to be purchased. All payments must be made by wire transfer of immediately available funds. If a potential investor’s subscription is not accepted, the General Partner will notify such potential investor as soon as practicable. |

All information is to be typed or printed in ink. |

||

Subscription Instructions

GREYSTONE HOUSING IMPACT INVESTORS LP

(A Delaware Limited Partnership)

Series B Preferred Units Representing Limited Partnership Interests

SUBSCRIPTION AGREEMENT

THIS SUBSCRIPTION AGREEMENT (the “Agreement”) is effective as of the date set forth on the signature page of the Subscription Acceptance hereof (the “Effective Date”), between the undersigned subscriber (the “Subscriber”), and Greystone Housing Impact Investors LP, a Delaware limited partnership (the “Partnership”).

Recitals

WHEREAS, the Partnership is offering for sale 10,000,000 Series B Preferred Units representing limited partnership interests of the Partnership (the “Series B Preferred Units”) at a price of $10.00 per unit (the “Offering”), with a minimum investment requirement of $5,000,000 (500,000 Series B Preferred Units) per subscriber, unless otherwise approved by the General Partner in its sole discretion; and

WHEREAS, the Partnership has filed, in accordance with the provisions of the Securities Act of 1933, as amended (the “Securities Act”) and the rules and regulations thereunder (the “Securities Act Regulations”), with the Securities and Exchange Commission (“Commission”) a registration statement on Form S-3 (File No. 333-[●]), covering the Series B Preferred Units to be issued from time to time by the Partnership, which was declared effective by the Commission on [●], 2024 (the “Registration Statement”); and

WHEREAS, the Partnership has prepared a prospectus dated [●], 2024 specifically relating to the Series B Preferred Units, which is included as part of the Registration Statement, pursuant to which the Series B Preferred Units are being offered by the Partnership in the Offering, which prospectus may be supplemented from time to time to add, update, or change information contained therein (the prospectus, including all documents incorporated therein by reference, included in the Registration Statement, as it may be supplemented from time to time by any prospectus supplement, in the form in which such prospectus and/or prospectus supplement have most recently been filed by the Partnership with the Commission pursuant to Rule 424(b) under the Securities Act Regulations, together with any then issued free writing prospectus, is referred to herein as the “Prospectus”); and

WHEREAS, all capitalized terms not otherwise defined herein shall have the meanings set forth in the Prospectus.

NOW, THEREFORE, in consideration of the promises made by the parties herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereby agree as follows.

Agreement

Section 1. Subscription for Series B Preferred Units. Subject to the terms and conditions of this Agreement, as of the Effective Date the Subscriber hereby subscribes for, and the Partnership agrees to issue to the Subscriber, that number of Series B Preferred Units of the Partnership set forth on the Subscriber’s signature page hereto. The closing of the purchase and sale of the Series B Preferred Units described herein shall occur at such time and location as the parties shall mutually agree (the “Closing,” and the date of the Closing, the “Closing Date”).

Section 2. Closing Deliveries. At the Closing, the Subscriber shall deliver or cause to be delivered to the Partnership the aggregate amount of the Subscriber’s amount of subscription, as set forth on the Subscriber’s signature page hereto, by wire transfer of immediately available funds to the account as specified by the Partnership. Upon the Closing, the Partnership shall deliver or cause to be delivered to the Subscriber the originally executed: (i) Confidential Subscriber Questionnaire completed by the Subscriber and accompanying this Agreement (the “Confidential Subscriber Questionnaire”); (ii) this Agreement; (iii) counterpart signature page to the Partnership Agreement, as countersigned by the General Partner; and (iv) such other evidence of the Subscriber’s record ownership of the Series B Preferred Units as may be reasonably requested by the Subscriber and mutually agreed to by the General Partner.

Subscription Agreement

S-1

Section 3. Representations and Warranties. The Subscriber understands that the Partnership is relying upon the representations and agreements contained in this Agreement (and any supplemental information) for the purpose of determining whether to accept the Subscriber’s subscription for Series B Preferred Units. Accordingly, the Subscriber hereby represents and warrants to the Partnership, and intends that the Partnership rely upon these representations and warranties for the purpose of establishing the acceptability of this Agreement, as follows:

(a) Subscriber Information. The address of the Subscriber in the Confidential Subscriber Questionnaire is the true and correct address of the domicile and residency of the Subscriber, and the Subscriber has no present intention of changing such address to another state or jurisdiction. The Subscriber agrees to promptly notify the Partnership if the information contained in this Agreement, the accompanying Confidential Subscriber Questionnaire, or any other document is or becomes incorrect.

(b) Investment Intent. The Subscriber is subscribing for the Series B Preferred Units for its own account and for investment purposes only, and not with a view to the distribution or resale thereof, in whole or in part, to anyone else.

(c) Liquidity. The Subscriber is in such a financial condition that it has no need for liquidity with respect to a subscription in the Series B Preferred Units and no need to dispose of any portion of the Series B Preferred Units subscribed for hereby to satisfy any existing or contemplated undertaking or indebtedness. The Subscriber hereby represents that, at the present time, the Subscriber could afford a complete loss of its subscription in the Series B Preferred Units.

(d) No Governmental Approvals of Offering. The Subscriber understands that no federal or state governmental agency or authority has passed upon the Series B Preferred Units or made any finding or determination concerning the fairness, advisability, or merits of the Offering or this subscription.

(e) Availability of Prospectus and Other Information. The Subscriber has received (or otherwise had made available to the Subscriber by the filing by the Partnership of an electronic version thereof with the Commission) the Prospectus which is a part of the Registration Statement, and the documents incorporated by reference therein, prior to or in connection with the execution of this Agreement. The Subscriber acknowledges that the Partnership has made available to it and its management the opportunity to ask questions and receive answers concerning the Partnership, the Partnership Agreement, and the Series B Preferred Units, and to obtain any additional information which the Partnership or General Partner possesses or can acquire without unreasonable effort or expense and has received any and all information requested.

(f) Independent Evaluation of Subscription. No representations or warranties have been made to the Subscriber concerning the Partnership, its business, the General Partner, or the Series B Preferred Units by the Partnership, the General Partner, any affiliate of the Partnership or the General Partner, or any agent, officer, or employee of any of them, or by any other person, other than as set forth in this Agreement, and in entering into this Agreement the Subscriber is not relying on any information other than the representations and warranties of the Partnership set forth herein and the results of the Subscriber’s own independent investigation and due diligence. In this regard, the Subscriber has made its own inquiry and analysis (on its own or with the assistance of others) with respect to the Partnership and its business, the General Partner, the Series B Preferred Units, the Partnership Agreement, and other material factors affecting the Series B Preferred Units. Based on such information and analysis, the Subscriber has been able to make an informed decision to subscribe for the Series B Preferred Units.

(g) Sophistication of Subscriber. The Subscriber has such knowledge and experience in financial and business matters that the Subscriber is capable of evaluating the merits and risks of a subscription in the Series B Preferred Units. To the extent necessary, the Subscriber has retained, at its own expense, and relied upon, appropriate professional advice regarding the investment, tax, and legal merits and consequences of this subscription and ownership of the Series B Preferred Units. The Subscriber understands that nothing in this Agreement, the Prospectus, the Registration Statement, or any other materials presented to the Subscriber in connection with the purchase and sale of the Series B Preferred Units constitutes legal, tax, regulatory, or investment advice.

Subscription Agreement

S-2

(h) No Public Market for the Series B Preferred Units. The Subscriber understands that there is no public market for the Series B Preferred Units, the Partnership does not intend for a public market in the Series B Preferred Units to develop, and such a public market is unlikely ever to develop.

(i) State of Domicile. The Subscriber’s state of domicile, both at the time of the initial offer of the Series B Preferred Units to the Subscriber and at the present time, was and is within the state set forth in the Subscriber’s address disclosed on this Agreement below.

(j) Organization and Authority; Subscriber Status. The Subscriber is duly organized, validly existing, and in good standing under the laws of the jurisdiction of its organization with the full right, corporate or partnership power, and authority to enter into and to consummate the transactions contemplated by this Agreement and to otherwise carry out its obligations hereunder. The execution, delivery, and performance by the Subscriber of the transactions contemplated by this Agreement have been duly authorized by all necessary corporate or similar action on the part of the Subscriber. The Subscriber’s governing instruments permit, and it is duly qualified to make, this subscription for the Series B Preferred Units. This Agreement and the Confidential Subscriber Questionnaire have been duly executed by the Subscriber, and when delivered by the Subscriber in accordance with the terms hereof, will constitute the valid and legally binding obligation of the Subscriber, enforceable against it in accordance with its terms. By executing this Agreement, the Subscriber hereby represents that the representations and warranties of the Subscriber set forth in the Confidential Subscriber Questionnaire attached to this Agreement, including the representations and warranties regarding the legal status of the Subscriber, are true and correct.

(k) Tax Consequences of Subscription. The Subscriber hereby acknowledges that there can be no assurance regarding the tax consequences of a subscription for the Series B Preferred Units, nor can there be any assurance that the Internal Revenue Code of 1986, as amended, or the regulations promulgated thereunder, or other applicable laws and regulations, will not be amended at some future time. In making this subscription for the Series B Preferred Units, the Subscriber hereby represents that it is relying solely upon the advice of the Subscriber’s tax advisor with respect to the tax aspects of a subscription for the Series B Preferred Units.

(l) Anti-Money Laundering Provisions. Neither the Subscriber nor (i) any person controlling or controlled by the Subscriber, (ii) any person having a beneficial interest in the Subscriber, or (iii) any person for whom the Subscriber is acting as agent or nominee in connection with this investment, is a person or entity with which the Partnership would be prohibited from engaging in a transaction under the rules and regulations administered by the U.S. Treasury Department’s Office of Foreign Assets Control. No funds the Subscriber will use for the purchase of Series B Preferred Units either now or for any future capital contributions, if any, were, and are not directly or indirectly derived from, activities that contravene U.S. federal, state, local, or international laws and regulations applicable to the Subscriber, including U.S. anti-money laundering laws and regulations. The Subscriber agrees to promptly notify the Partnership if any of the foregoing representations in this Section 3(l) cease to be true and accurate regarding the Subscriber. The Subscriber also agrees to provide the Partnership and the General Partner with any additional information regarding the Subscriber that the Partnership or General Partner deems necessary or convenient to ensure compliance with the foregoing representations. The Subscriber understands and agrees that if at any time it is discovered that any of the foregoing representations are incorrect, or if otherwise required by applicable law or regulation related to money laundering or similar activities, the Partnership may undertake appropriate actions to ensure compliance with applicable laws or regulations, including, but not limited to, segregation and/or redemption of the Subscriber’s investment in the Series B Preferred Units. The Subscriber further understands that the Partnership may release confidential information about the Subscriber and, if applicable, any underlying beneficial owners of the Subscriber, to the proper authorities if the General Partner, in its sole discretion, determines that it is in the best interests of the Partnership in light of the foregoing described anti-money laundering rules.

(m) No Right to Require Registration Upon Resale. The Subscriber understands that the Subscriber has no right to require the Partnership to register the further resale of the Subscriber’s Series B Preferred Units under federal or state securities laws at any time.

Subscription Agreement

S-3

Section 4. Representations and Warranties of the Partnership. The Partnership understands that the Subscriber is relying upon the representations and agreements contained in this Section 4 for the purpose of determining whether to enter into this Agreement for the subscription for the Series B Preferred Units. Accordingly, the Partnership hereby represents and warrants to the Subscriber, and intends that the Subscriber rely upon these representations and warranties for the purpose of establishing the acceptability of this Agreement, as follows:

(a) Organization. The Partnership is duly organized, validly existing as a limited partnership, and in good standing under the laws of the State of Delaware. The Partnership is duly licensed or qualified as a foreign limited partnership for transaction of business and in good standing under the laws of each other jurisdiction in which its ownership or lease of property or the conduct of its business requires such license or qualification, and has all limited partnership power and authority necessary to own or hold its properties and to conduct its business as described in the Registration Statement and the Prospectus, except where the failure to be so qualified or in good standing or have such power or authority would not, individually or in the aggregate, have a material adverse effect on or affecting the assets, business, operations, earnings, properties, condition (financial or otherwise), prospects, partners’ equity or results of operations of the Partnership or prevent or materially interfere with consummation of the transactions contemplated hereby (a “Material Adverse Effect”).

(b) Registration Statement. The Registration Statement has heretofore become effective under the Securities Act; no order of the Commission preventing or suspending the use of the Prospectus or any prospectus supplement related thereto has been issued, no stop order suspending the effectiveness of the Registration Statement has been issued, and no proceedings for such purpose have been instituted or, to the Partnership’s knowledge, are contemplated by the Commission.

(c) Authorization of Series B Preferred Units. The Series B Preferred Units, when issued and delivered pursuant to the terms approved by the Board of Managers of the general partner of the General Partner of the Partnership, against payment therefor as provided herein, will be duly and validly authorized and issued and fully paid and nonassessable, free and clear of any pledge, lien, encumbrance, security interest or other claim, including any statutory or contractual preemptive rights, resale rights, rights of first refusal or other similar rights. The Series B Preferred Units, when issued, will conform in all material respects to the description thereof set forth in or incorporated into the Prospectus.

(d) Authorization; Enforceability. The Partnership has full legal right, power, and authority to enter into this Agreement and perform the transactions contemplated hereby. This Agreement has been duly authorized, executed, and delivered by the Partnership and is a legal, valid, and binding agreement of the Partnership enforceable in accordance with its terms, except to the extent that enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium, or similar laws affecting creditors’ rights generally and by general equitable principles.

(e) Title to Real and Personal Property. The Partnership has good and valid title in fee simple to all items of real property and good and valid title to all personal property described in the Registration Statement or Prospectus as being owned by it that are material to the business of the Partnership, in each case free and clear of all liens, encumbrances and claims, except those that (i) do not materially interfere with the use made and proposed to be made of such property by the Partnership, or (ii) would not reasonably be expected, individually or in the aggregate, to have a Material Adverse Effect. Any real property described in the Registration Statement or Prospectus as being leased by the Partnership is held by it under valid, existing, and enforceable leases, except those that (x) do not materially interfere with the use made or proposed to be made of such property by the Partnership, or (y) would not be reasonably expected to have a Material Adverse Effect.

Section 5. Closing Conditions.

(a) Conditions to the Partnership’s Obligations. The Partnership’s obligation to sell the Series B Preferred Units and to take the other actions required to be taken by the Partnership at the Closing is subject to the satisfaction, at or prior to the Closing, of each of the following conditions (any of which may be waived by the Partnership, in whole or in part):

Subscription Agreement

S-4

(i) the accuracy in all material respects as of the date hereof and at the Closing of the representations and warranties by the Subscriber contained herein and in the Confidential Subscriber Questionnaire; and

(ii) the delivery by the Subscriber of the Purchase Price to the Partnership for the Series B Preferred Units as set forth herein on the Closing Date.

(b) Conditions to the Subscriber’s Obligations. The Subscriber’s obligation to purchase the Series B Preferred Units and to take the other actions required to be taken by the Subscriber at the Closing is subject to the satisfaction, at or prior to the Closing, of each of the following conditions (any of which may be waived by the Subscriber, in whole or in part):

(i) the accuracy in all material respects as of the date hereof and at the Closing of the representations and warranties by the Partnership contained herein;

(ii) the delivery by the Partnership to the Subscriber of the closing deliveries described in Section 2 hereof; and

(iii) at the time of the Closing, no stop order with respect to the effectiveness of the Registration Statement shall have been issued under the Securities Act or proceedings initiated under Section 8(d) or 8(e) of the Securities Act.

Section 6. Other Covenants.

(a) Governing Law. The Subscriber agrees that, notwithstanding the place where this Agreement may be executed by any of the parties hereto, all the terms and provisions hereof shall be construed in accordance with and governed by the laws of the State of Delaware, without regard to principles of conflicts of laws. The Subscriber hereby irrevocably agrees that any suit, action, or proceeding with respect to this Agreement and any or all transactions relating hereto shall be brought in the local courts in New Castle County, Delaware or in the U.S. District Court for the District of Delaware, as the case may be.

(b) Indemnification of the Partnership and Others. The Subscriber agrees to hold the Partnership, the General Partner, and its officers, managers, and controlling persons (as defined in the Securities Act), and any persons affiliated with any of them or with the issuance of the Series B Preferred Units, harmless from all expenses, liabilities, and damages (including reasonable attorneys’ fees) deriving from a disposition of the Series B Preferred Units by the Subscriber in a manner in violation of the Securities Act, or of any applicable state securities law or which may be suffered by any such person by reason of any breach by the Subscriber of any of the representations contained herein.

(c) Use of Proceeds. The Partnership will use the proceeds from the Offering as described in the Prospectus.

Section 7. Amendments. Neither this Agreement nor any term hereof may be amended, changed, or revised without the prior written consent of all the parties hereto.

Section 8. Execution and Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be an original but all of which taken together shall constitute one and the same Agreement, it being understood that the parties need not sign the same counterpart. In the event that any signature on this Agreement or any instrument pursuant to Section 7 hereof is delivered by e-mail delivery of a “.pdf” format data file, such signature shall create a legally valid and binding obligation of the executing party (or on whose behalf such signature is executed) with the same force and effect as if such “.pdf” signature page was an original thereof.

Subscription Agreement

S-5

Section 9. Entire Agreement. This Agreement and the Confidential Subscriber Questionnaire contain the entire agreement and understanding of the parties with respect to its subject matter and supersedes all prior agreements and understandings between the parties with respect to their subject matter.

Section 10. Severability. If any term, provision, covenant, or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, illegal, void, or unenforceable, the remainder of the terms, provisions, covenants, and restrictions set forth herein shall remain in full force and effect and shall in no way be affected, impaired, or invalidated, and the parties hereto shall use their commercially reasonable efforts to find and employ an alternative means to achieve the same or substantially the same result as that contemplated by such term, provision, covenant, or restriction.

Section 11. WAIVER OF JURY TRIAL. IN ANY ACTION, SUIT, OR PROCEEDING IN ANY JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, EACH PARTY HEREBY KNOWINGLY AND INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY, AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY.

Section 12. Miscellaneous. This Agreement is not transferable or assignable by the Subscriber without the prior written consent of the Partnership. All notices or other communications to be given or made hereunder to the Subscriber shall be in writing and may be hand delivered or sent by fax, certified or registered mail, postage prepaid, e-mail, or by a private overnight delivery service to the Subscriber’s address set forth below. The headings herein are for convenience only, do not constitute a part of this Agreement, and shall not be deemed to limit or affect any of the provisions hereof. This Agreement shall be binding upon and inure to the benefit of the parties and their permitted successors and assigns. This Agreement is intended for the benefit of the parties hereto and their respective permitted successors and assigns and is not for the benefit of, nor may any provision hereof be enforced by, any other person, except as set forth in Section 6(b) of this Agreement. The representations, warranties, and covenants contained herein shall survive the Closing and the delivery of the Series B Preferred Units.

[Remainder of Page Intentionally Left Blank]

Subscription Agreement

S-6

IN WITNESS WHEREOF, the parties have executed this Subscription Agreement to be effective as of the Effective Date set forth below on the Subscription Acceptance.

Subscriber:

Name of Subscriber:

Address of Subscriber:

Signature of Authorized Signatory:

Name and Title of Authorized Signatory:

Number of Series B Preferred Units Subscribed For:

Aggregate Amount of Subscription: $

Date Signed by Subscriber:

Selection of Designated Target Region:

The Subscriber indicated above hereby selects the following as the Designated Target Region for the Subscriber’s investment:

Complete One:

The State of .

The multi-state region including .

The metropolitan area of .

The entire United States.

The Subscriber also may specify the amount of the Subscriber’s investment proceeds to be allocated to one or more of the following Specified CRA Assets:

The Subscriber may also request an allocation of capital to specific investments already within the portfolio. Such requests to be allocated as according to the “CRA Credit Allocation Methodology” set forth in the Prospectus and subject to confirmation by the General Partner.

Property Name |

State |

Allocation Request Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription Agreement

S-7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By signing this Agreement, the Subscriber acknowledges reading and agrees to the provisions set forth in the section captioned “CRA Credit Allocation Methodology” of the Prospectus. The Subscriber acknowledges that the General Partner provides no guarantee that the Subscriber will receive CRA credit for its investment in the Series B Preferred Units.

Subscription Agreement

S-8

Subscription Acceptance

This Agreement is accepted as of _________________, 20___, which shall be the Effective Date of the subscription described in this Agreement.

|

GREYSTONE HOUSING IMPACT INVESTORS LP |

|

|

|

|

|

By: |

|

|

|

Kenneth C. Rogozinski, Chief Executive Officer |

Subscription Agreement

S-9

GREYSTONE HOUSING IMPACT INVESTORS LP

CONFIDENTIAL SUBSCRIBER QUESTIONNAIRE

In connection with the offer and issuance by Greystone Housing Impact Investors LP, a Delaware limited partnership (the “Partnership”), of up to 10,000,000 Series B Preferred Units representing limited partnership interests of the Partnership (the “Series B Preferred Units”), the undersigned hereby represents and warrants to the Partnership and the General Partner and intends that the Partnership and the General Partner rely upon the representations and warranties, as set forth below. All capitalized terms not otherwise defined herein shall have the meanings set forth in that certain prospectus dated [●], 2024, which is included as part of the registration statement on Form S-3 (File No. 333-[●])(the “Registration Statement”), filed by the Partnership with the Securities and Exchange Commission (“SEC”) on September 17, 2024 and declared effective on [●], 2024, as such prospectus may be supplemented from time to time (as supplemented, the “Prospectus”).

I. Subscriber Status

The Subscriber represents and warrants that it satisfies one or more of the following categories (check all applicable paragraphs):

☐ The Subscriber is a bank as defined in Section 3(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), or any savings and loan association or other institution as defined in Section 3(a)(5)(A) of the Securities Act, whether acting in its individual or fiduciary capacity;

☐ The Subscriber is a broker or dealer registered pursuant to Section 15 of the Securities Exchange Act of 1934, as amended;

☐ The Subscriber is an investment adviser registered pursuant to Section 203 of the Investment Advisers Act of 1940, as amended (the “Advisers Act”), or registered pursuant to the laws of any state;

☐ The Subscriber is an investment adviser relying on the exemption from registering with the Securities and Exchange Commission under Section 203(l) or (m) of the Advisers Act;

☐ The Subscriber is an insurance company as defined in Section 2(a)(13) of the Securities Act;

☐ The Subscriber is an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) or a business development company as defined in Section 2(a)(48) of that Act;

☐ The Subscriber is a Small Business Investment Company licensed by the U.S. Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958;

☐ The Subscriber is a Rural Business Investment Company as defined in Section 384A of the Consolidated Farm and Rural Development Act;

☐ The Subscriber is a plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has total assets in excess of $5,000,000;

☐ The Subscriber is an employee benefit plan within the meaning of Title I of the Employee Retirement Income Security Act of 1974, as amended, if the investment decision is made by a plan fiduciary, as defined in Section 3(21) of such Act, which is either a bank, savings and loan association, insurance company, or registered investment adviser, or if the employee benefit plan has total assets in excess of $5,000,000 or, if a self-directed plan, with investment decisions made solely by persons who are “accredited investors” as defined under Securities Act Rule 501;

☐ The Subscriber is a private business development company as defined in Section 202(a)(22) of the Advisers Act;

☐ The Subscriber is an organization described in Section 501(c)(3) of the Internal Revenue Code, a corporation, a Massachusetts or similar business trust, a partnership, or a limited liability company not formed for the specific purpose of acquiring the securities offered, and has total assets in excess of $5,000,000;

☐ The Subscriber is a trust, with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the securities offered, whose purchase is directed by a person who has such knowledge and experience in financial and business matters that such person is capable of evaluating the merits and risks of a prospective investment;

☐ The Subscriber is an entity in which all of the equity owners are “accredited investors” under one or more of the above paragraphs; or

☐ The Subscriber is an entity of a type not listed above, not formed for the specific purpose of acquiring the securities offered, and owns “investments” (as defined in Rule 2a51-1(b) of the 1940 Act) in excess of $5,000,000.

II. Authorization of Agents

Please provide below the names of the persons authorized by the Subscriber to give and receive instructions between the Partnership and the undersigned Subscriber with respect to the Subscriber’s investment in the Series B Preferred Units. Such persons are the only persons so authorized until further notice to the Partnership.

Name |

Title |

Telephone |

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Subscriber agrees to notify the Partnership and the General Partner immediately of any change in the information provided in this Confidential Purchaser Questionnaire prior to the execution of the Subscriber’s subscription for Series B Preferred Units.

III. Subscriber Acknowledgments

The undersigned Subscriber hereby confirms its agreement to purchase the Series B Preferred Units on the terms and conditions set forth in the Subscription Agreement accompanying this questionnaire and executed by the Subscriber and accepted by the General Partner, and acknowledges and/or represents the following (you must check all of the representations below in order to be eligible to invest):

☐ The Subscriber has received, read, and understands the Registration Statement, as modified or amended, including the related Prospectus, filed by the Partnership with the SEC in connection with the offering of the Series B Preferred Units, and the annual and periodic reports of the Partnership filed with the SEC (which are incorporated by reference into the Registration Statement and Prospectus), wherein the terms, conditions, and risks of the offering are described.

☐ The Subscriber is purchasing the Series B Preferred Units for its own account, for investment, and not with a view to a further distribution thereof.

☐ The Subscriber is not subject to any statute, regulation, rule, order, directive, memorandum of understanding, resolution, or other mandate from any governmental entity, regulatory body, or court of competent jurisdiction which prevents, limits, or restricts the Subscriber’s investment in the Series B Preferred Units, as described in the accompanying Subscription Agreement.

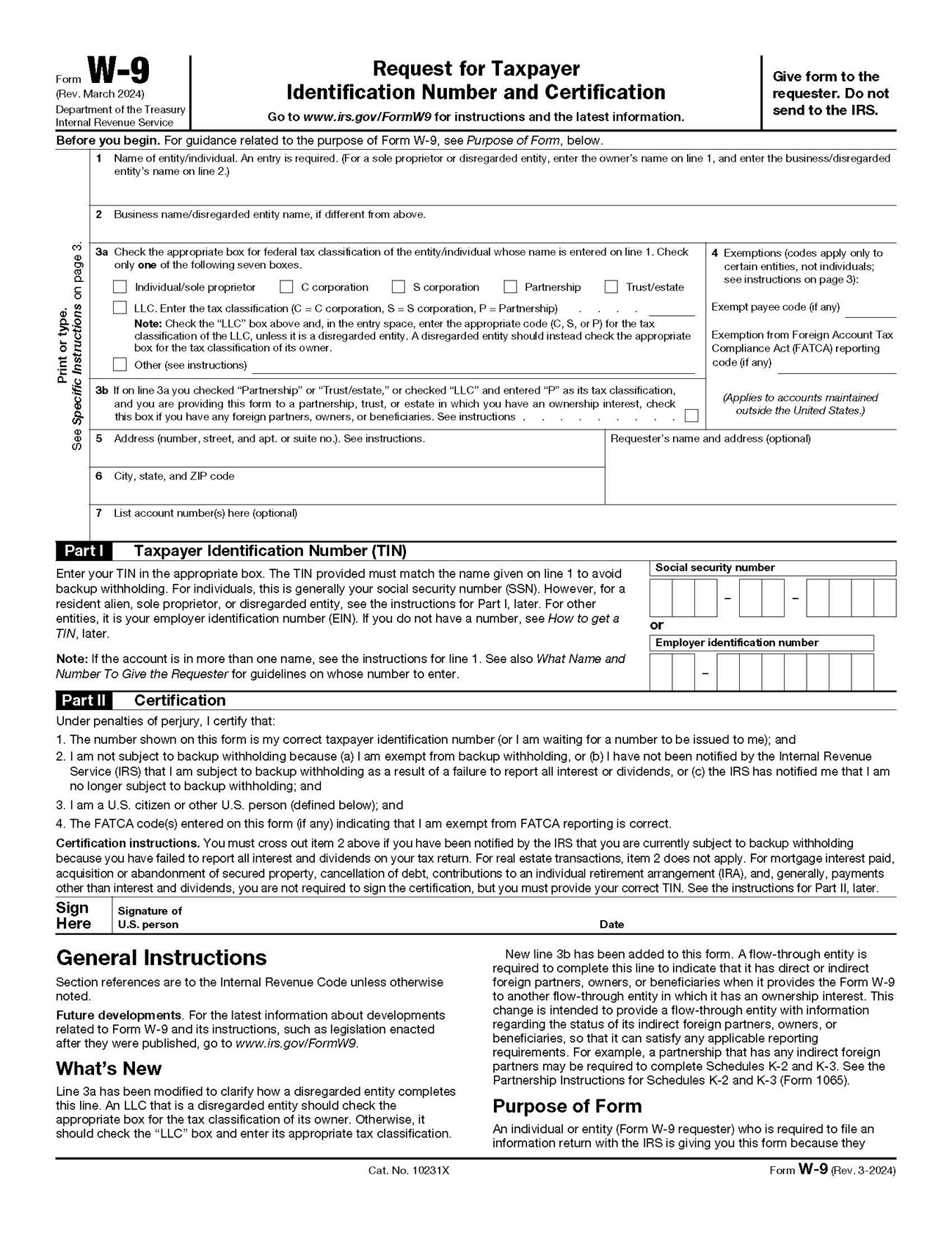

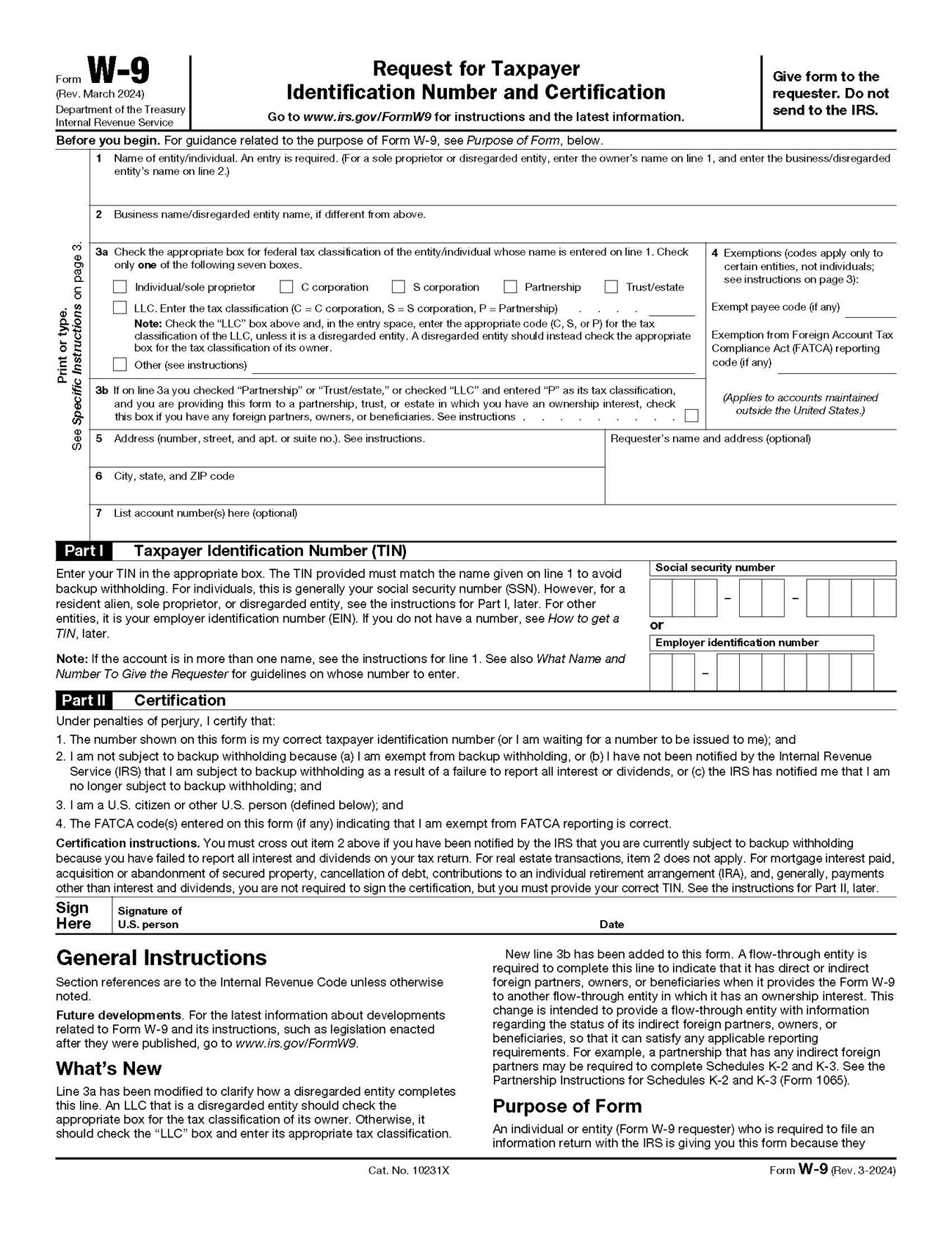

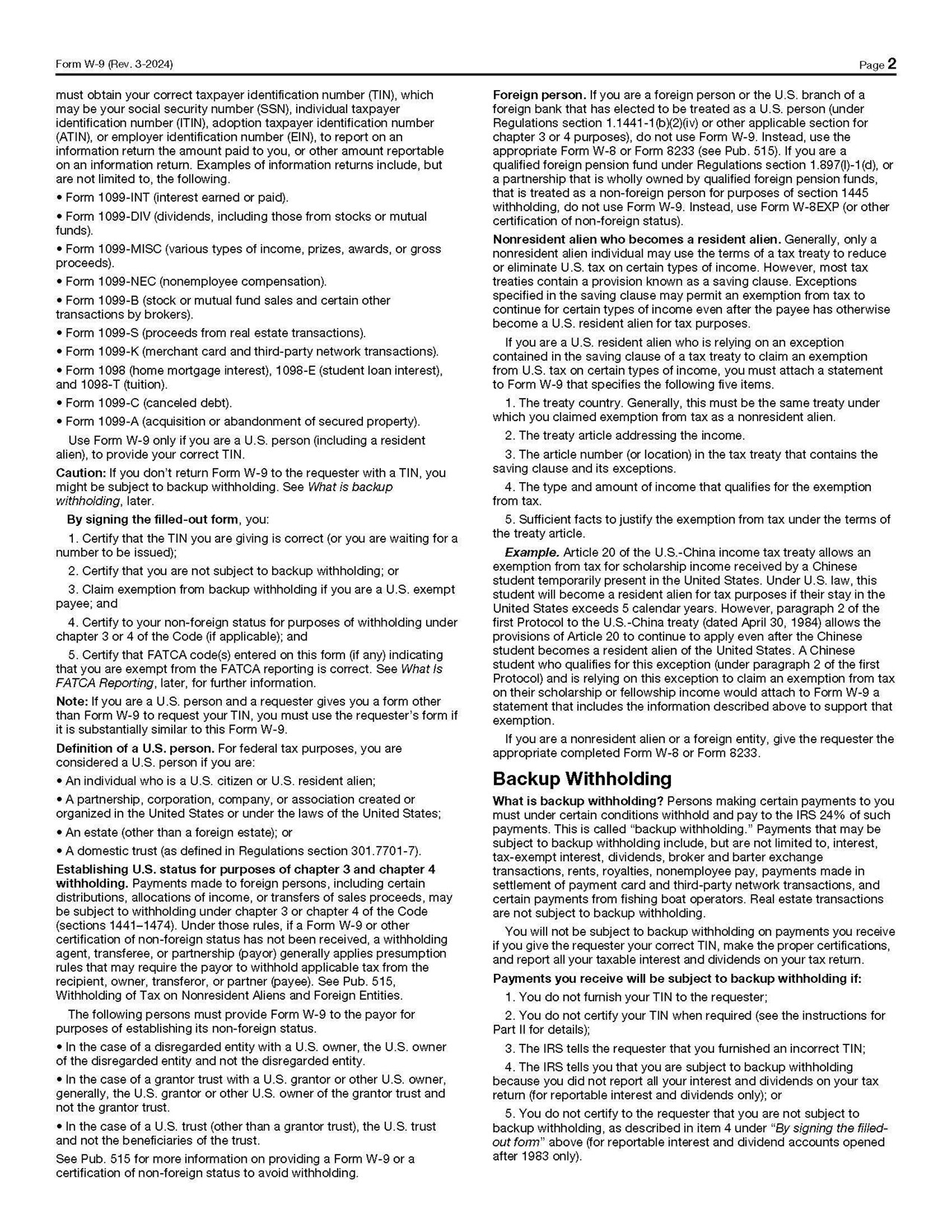

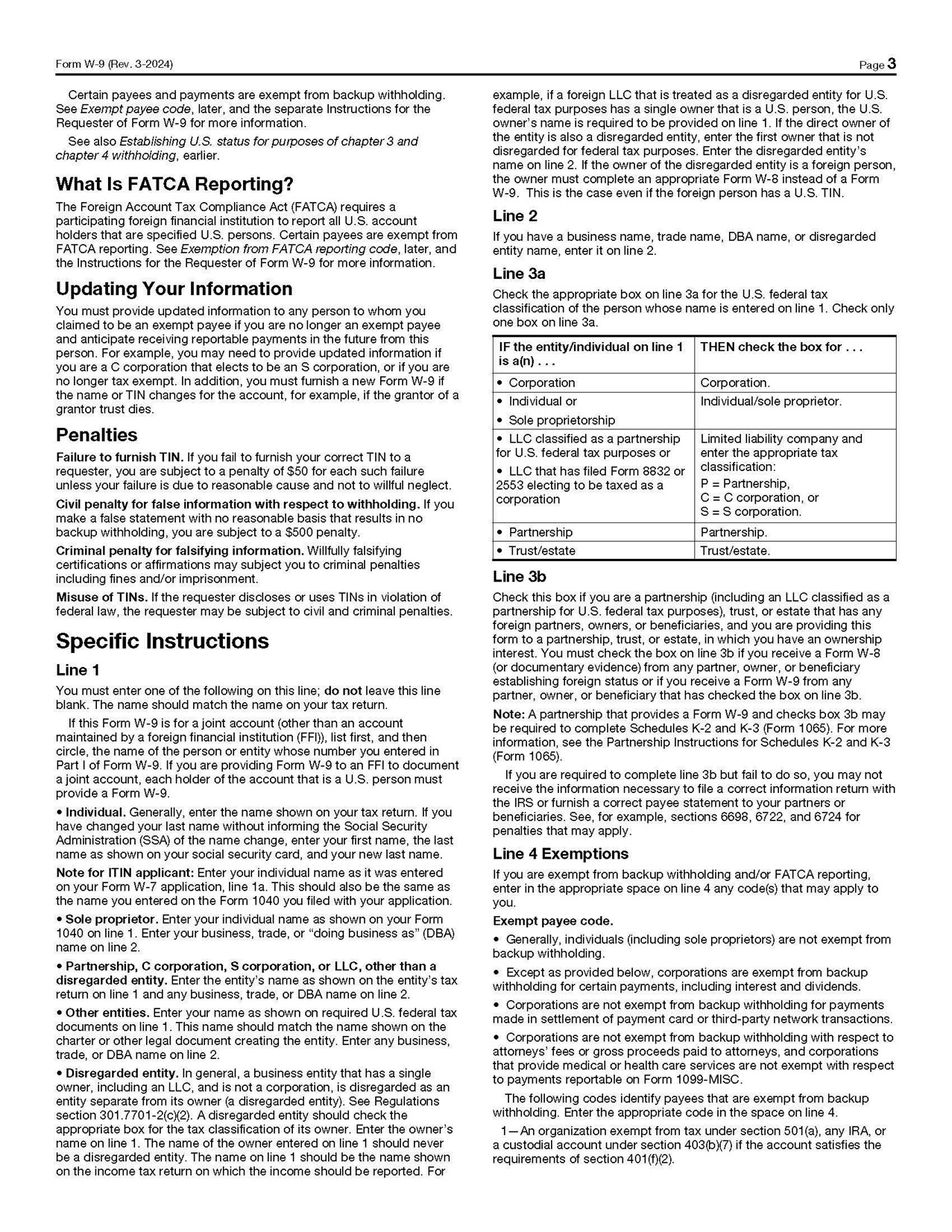

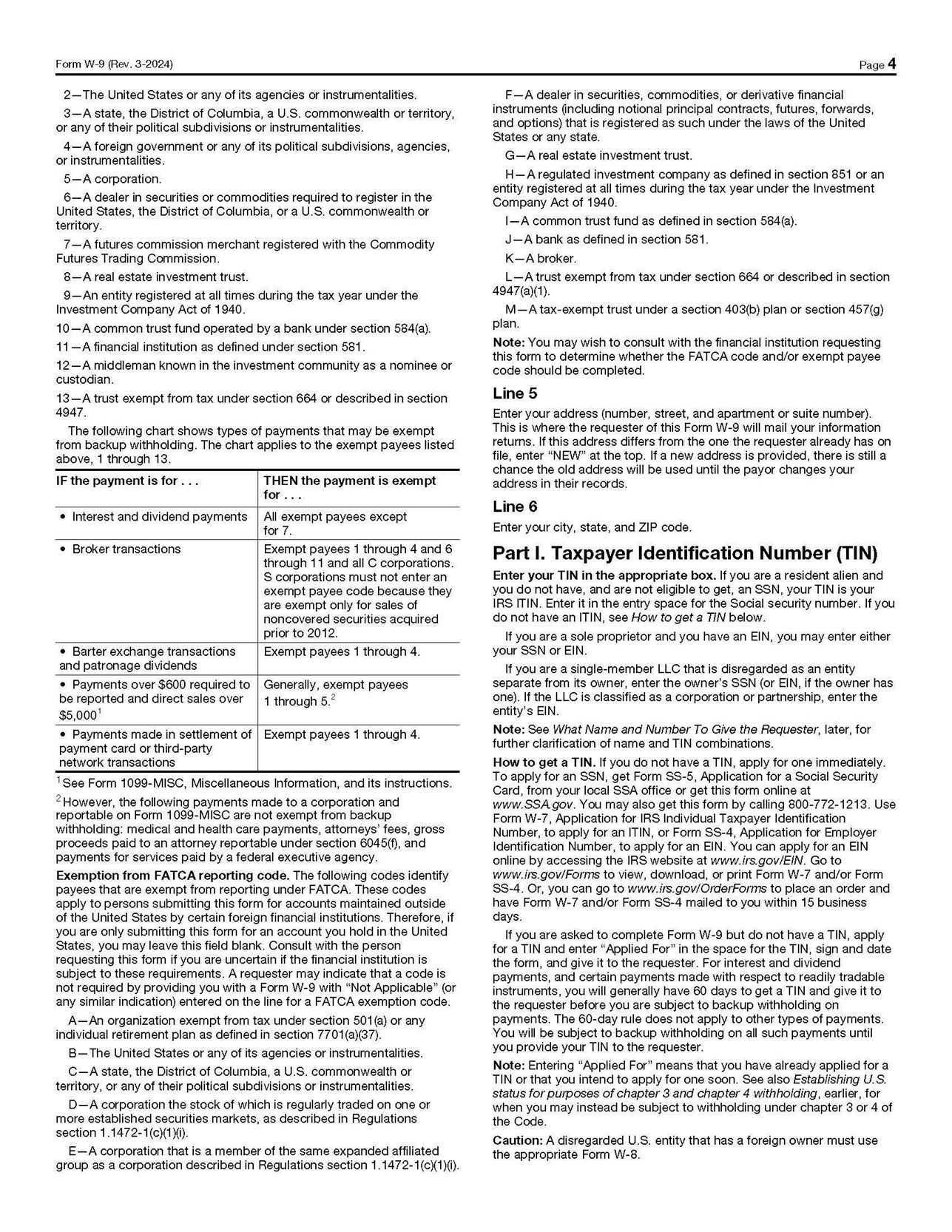

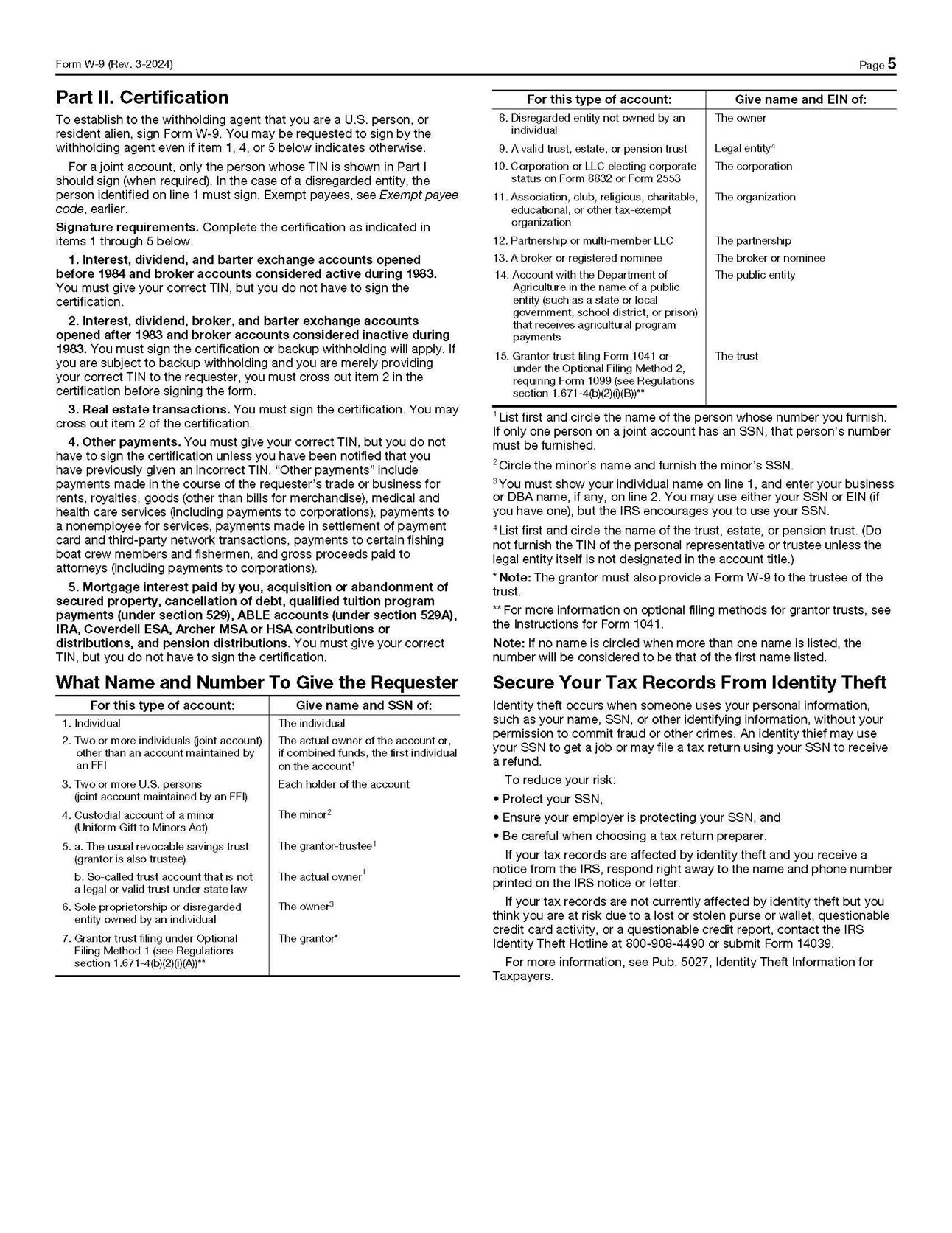

IV. Taxpayer ID Certification

Please complete and execute, in full, the certification beginning on the following page and submit the certification to the Partnership. The Taxpayer ID number should correspond to the Subscriber.

(See Following Pages Attached)

[Signature Page Follows]

IN WITNESS WHEREOF, the Subscriber has executed this Confidential Subscriber Questionnaire this _____ day of _____________, 20___.

SUBSCRIBER:

By:

Name:

Title:

Address of Subscriber:

Telephone:

Authorized E-Mail Address:

Federal EIN: