Exhibit 99.1

Supplemental Financial Report for the

Quarter Ended September 30, 2020

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS, L.P.

All statements in this document other than statements of historical facts, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. When used, statements which are not historical in nature, including those containing words such as “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” and similar expressions, are intended to identify forward-looking statements. We have based forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. This document may also contain estimates and other statistical data made by independent parties and by us relating to market size and growth and other industry data. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the statistical and other industry data generated by independent parties contained in this supplement and, accordingly, we cannot guarantee their accuracy or completeness. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described under the headings “Item 1A Risk Factors” in our 2019 Annual Report on Form 10-K for the year ended December 31, 2019 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020, June 30, 2020 and September 30, 2020. These forward-looking statements are subject to various risks and uncertainties and America First Multifamily Investors, L.P. (“ATAX” or “Partnership”) expressly disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Most, but not all, of the selected financial information furnished herein is derived from the America First Multifamily Investors, L.P.’s consolidated financial statements and related notes prepared in conformity with generally accepted accounting principles in the United States of America (“GAAP”) and management’s discussion and analysis of financial condition and results of operations included in the Partnership’s reports on Forms 10-K and 10-Q. The Partnership’s annual consolidated financial statements were subject to an independent audit, dated February 26, 2020.

Disclosure Regarding Non-GAAP Measures

This document refers to certain financial measures that are identified as non-GAAP. We believe these non-GAAP measures are helpful to investors because they are the key information used by management to analyze our operations. This supplemental information should not be considered in isolation or as a substitute for the related GAAP measures.

Please see the consolidated financial statements we filed with the Securities and Exchange Commission on Forms 10-K and 10-Q. Our GAAP consolidated financial statements can be located upon searching for the Partnership’s filings at www.sec.gov.

|

|

|

|

|

|

|

PARTNERSHIP FINANCIAL INFORMATION

TABLE OF CONTENTS

|

|

Pages |

|

|

|

Supplemental Letter from the CEO |

4 |

|

|

Quarterly Fact Sheet |

6 |

|

|

Financial Performance Trend Graphs |

7-12 |

|

|

Other Partnership Information |

13 |

|

|

Partnership Financial Measures |

14-15 |

|

|

|

|

|

|

|

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS L.P.

SUPPLEMENTAL LETTER FROM THE CEO

During the third quarter of 2020, ATAX continued to focus on monitoring the impact of COVID-19 on our business, taking advantage of strategic investment opportunities, and strengthening relationships with our business partners.

We reported the following financial results as of and for the three months ended September 30, 2020:

|

|

• |

Total revenues of approximately $13.8 million |

|

|

• |

Net loss, basic and diluted, of ($0.03) per Beneficial Unit Certificate (“BUC”) |

|

|

• |

Cash Available for Distribution of $0.06 per BUC |

|

|

• |

Total assets of approximately $1.2 billion |

|

|

• |

Total Mortgage Revenue Bond (“MRB”) investments of approximately $796.5 million |

We reported the following notable transactions during the third quarter of 2020:

|

|

• |

Committed to fund one MRB totaling up to $15.0 million and fund one taxable MRB totaling up to $7.0 million for construction of an affordable multifamily property. ATAX advanced MRB funds totaling $2.0 million during the third quarter of 2020, with remaining MRB and taxable MRB commitments to be funded throughout the construction period. |

|

|

• |

Committed to fund two Governmental Issuer Loans (“GIL”) totaling up to $67.1 million and fund two property loans totaling up to $52.0 million for construction of two affordable multifamily properties. ATAX advanced GIL funds totaling $22.1 million and advanced property loan funds of $3.0 million during the third quarter of 2020, with remaining commitments to be funded throughout the construction period. |

|

|

• |

Entered into initial TOB Trust financings related to one MRB, two GILs and two property loans for net proceeds of $26.5 million. |

|

|

• |

Invested capital in one unconsolidated entity of $6.4 million. |

|

|

• |

Received redemption proceeds on one MRB totaling $6.5 million. |

|

|

• |

Issued five-year secured notes to Mizuho Capital Markets secured by cash flows associated with our residual interests in our TEBS financing arrangements for gross principal of $103.5 million. We concurrently reduced the effective interest rate on the notes by entering into two total return swaps with Mizuho. Approximately $24.8 million of proceeds were immediately available for ATAX’s use with the remaining posted as collateral with Mizuho for the two total return swaps. Of this amount, ATAX can make approximately $41.3 million in additional cash available for use by March 2022. |

|

|

• |

Extended the maturity date of ten TOB Trust financings from dates in 2021 to July 2023. |

|

|

• |

Extended the maturity date of two unsecured lines of credit to June 2022. |

|

|

4 |

|

|

|

|

The impacts of COVID-19 on the general economy and our operations continue to evolve. What we do know is that:

|

|

• |

Our business partners remain open for business. |

|

|

• |

We have access to capital markets as needed. |

|

|

• |

All our multifamily MRBs are current on contractual principal and interest payments as of September 30, 2020. |

|

|

• |

We have received no requests for forbearance on multifamily MRBs to date, though we have received forbearance requests related to our sole student housing MRB and our sole commercial property MRB. |

|

|

• |

There have been no supply chain disruptions for labor or building materials at the Vantage properties. |

|

|

• |

Despite the impacts of COVID-19, our student housing MF Properties continue to meet all mortgage and operational obligations with cash flows from operations. |

|

|

• |

Our team continue to perform at a high level while observing policies that align with recommendations and requirements of the U.S. Centers for Disease Control and Prevention. |

We are committed to managing ATAX through the uncertainties of COVID-19 and the repercussions in the general market in the best interest of our unitholders.

Thank you for your continued support of ATAX!

/s/ Chad L. Daffer

Chad L. Daffer

Chief Executive Officer

|

|

5 |

|

|

|

|

|

PARTNERSHIP DETAILS |

|

ATAX was formed for the primary purpose of acquiring a portfolio of MRBs that are issued to provide construction and/or permanent financing of multifamily residential properties. We continue to expect most of the interest paid on these MRBs to be excludable from gross income for federal income tax purposes. In addition, we have invested in equity interests in multifamily, market rate projects throughout the U.S. We have also acquired interests in multifamily projects (“MF Properties”) to position ourselves for future investments in MRBs issued to finance these properties or to operate the MF Properties until their “highest and best use” can be determined. We continue to pursue a business strategy of acquiring additional MRBs, on a leveraged basis, and other investments.

|

|||||||||

|

(As of September 30, 2020) |

|

||||||||||

|

|

|

||||||||||

|

Symbol (NASDAQ) |

|

|

ATAX |

|

|||||||

|

Most Recent Quarterly Distribution |

|

$ |

0.06 |

|

|||||||

|

Unit Price |

|

$ |

4.05 |

|

|||||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|||||||

|

BUCs Outstanding (including Restricted Units) |

|

|

60,835,204 |

|

|||||||

|

Market Capitalization |

|

$ |

246,382,576 |

|

|||||||

|

52-week BUC price range |

|

$3.58 to $8.10 |

|

||||||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|||||||

|

Partnership Financial Information for Q3 2020 ($’s in 000’s, except per BUC amounts)

|

|

||||||||||

|

|

9/30/2020 |

|

12/31/2019 |

|

|||||||

|

|

|

|

|

|

|||||||

|

Total Assets |

$1,174,625 |

|

$1,029,169 |

|

|||||||

|

Leverage Ratio1 |

66% |

|

61% |

|

|||||||

|

|

|

|

|

|

|||||||

|

|

Q3 2020 |

|

YTD 2020 |

|

|||||||

|

|

|

|

|

|

|||||||

|

Total Revenue |

$13,840 |

|

$42,055 |

|

|||||||

|

Net Income (Loss) |

$(1,160) |

|

$6,410 |

|

|||||||

|

Cash Available for Distribution (“CAD”)2 |

$3,873 |

|

$12,410 |

|

|||||||

|

Distribution Declared per BUC3 |

$0.060 |

|

$0.245 |

|

|||||||

|

|

|

|

|

|

|||||||

|

1 |

Our overall leverage ratio is calculated as total outstanding debt divided by total assets using cost adjusted for paydowns and allowances for MRBs, Governmental Issuer Loans, PHC Certificates, property loans, and taxable MRBs, and initial cost for deferred financing costs and MF Properties. |

|

2 |

Management utilizes a calculation of Cash Available for Distribution (“CAD”) to assess the Partnership’s operating performance. This is a non-GAAP financial measure and a reconciliation of our GAAP net income (loss) to CAD is provided on page 14 of the Supplement herein. |

|

3 |

The most recent distribution was paid on October 30, 2020 for BUC holders of record as of September 30, 2020. The distribution is payable to BUC holders of record as of the last business day of the quarter end and ATAX trades ex-dividend two days prior to the record date, with a payable date of the last business day of the subsequent month. |

|

|

6 |

|

|

|

|

|

|

7 |

|

|

|

|

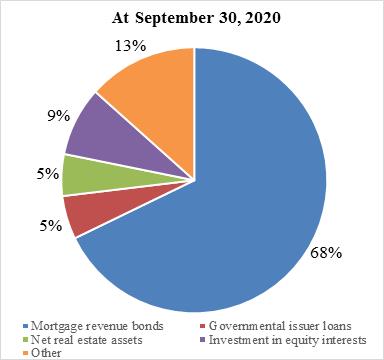

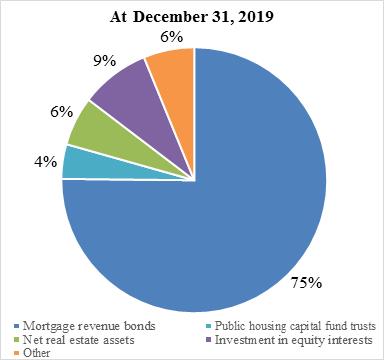

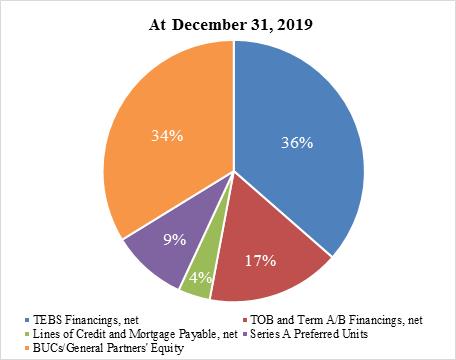

ATAX MORTGAGE INVESTMENT PROFILE

1 Mortgage Investments include the Partnership’s MRBs and Governmental Issuer Loans.

|

|

8 |

|

|

|

|

|

|

9 |

|

|

|

|

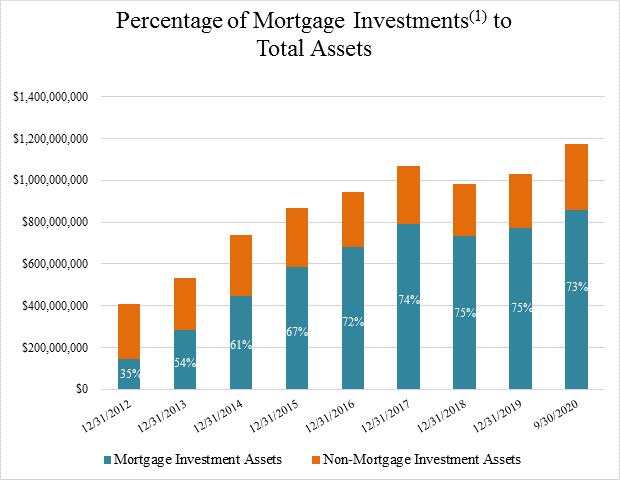

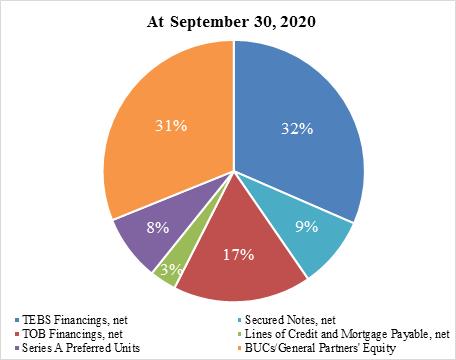

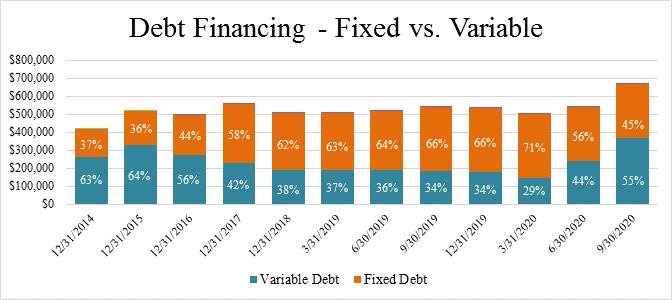

DEBT FINANCING, NET ($’s in 000’s)

INTEREST RATE SENSITIVITY ANALYSIS1

|

Description |

|

- 25 basis points |

|

+ 50 basis points |

|

+ 100 basis points |

|

+ 150 basis points |

|

+ 200 basis points |

|

TOB Debt Financings |

|

$431,568 |

|

$(863,795) |

|

$(1,727,591) |

|

$(2,591,386) |

|

$(3,455,181) |

|

TEBS Debt Financings |

|

130,772 |

|

(261,545) |

|

(523,089) |

|

(784,634) |

|

(1,046,178) |

|

Other Investment Financings |

|

(92,566) |

|

54,752 |

|

(4,463) |

|

(63,678) |

|

(122,893) |

|

Variable Rate Investments |

|

(75,651) |

|

161,752 |

|

511,271 |

|

871,781 |

|

1,250,470 |

|

Total |

|

$394,123 |

|

$(908,836) |

|

$(1,743,872) |

|

$(2,567,917) |

|

$(3,373,782) |

|

|

1 |

Represents the change over the next 12 months assuming an immediate shift in rates and management does not adjust its strategy in response. |

|

|

10 |

|

|

|

|

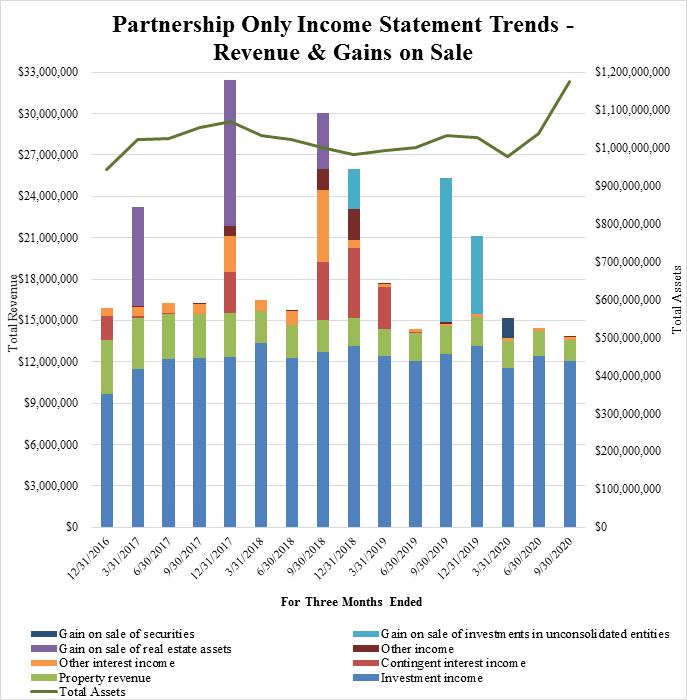

TOTAL REVENUE & GAIN ON SALE TRENDS

|

|

11 |

|

|

|

|

|

|

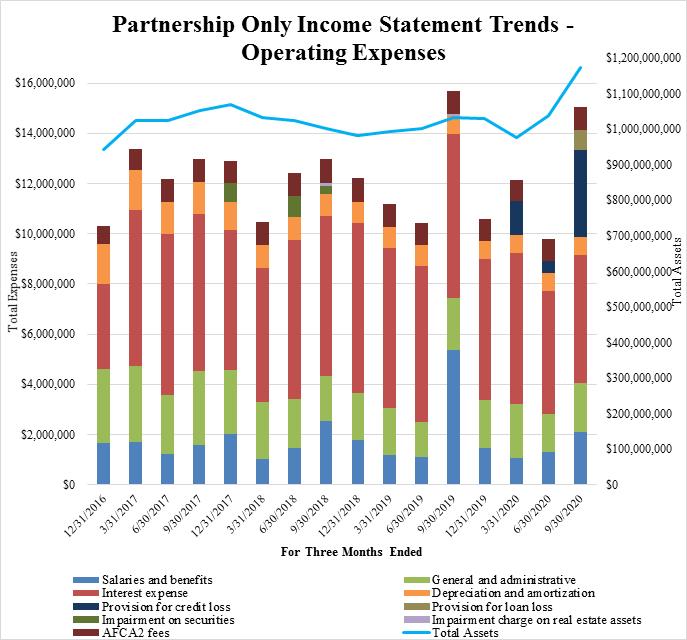

• |

Since October 1, 2018, the ratio of “Salaries and benefits” and “General and administrative” expenses to Total assets has averaged approximately 0.37% per quarter. |

|

|

• |

Salaries and benefits expense for the three months ended September 30, 2019 includes approximately $2.7 million of expense related to the accelerated vesting of restricted units upon the change in control of ATAX’s general partner on September 10, 2019. |

|

|

12 |

|

|

|

|

|

OTHER PARTNERSHIP INFORMATION |

|||||

|

|

|

|

|

||

|

Corporate Office: |

|

|

Transfer Agent:

|

||

|

14301 FNB Parkway |

|

|

American Stock Transfer & Trust Company |

||

|

Suite 211 |

|

|

59 Maiden Lane |

||

|

Omaha, NE 68154 |

|

|

Plaza Level |

||

|

Phone: |

402-952-1235 |

|

New York, NY 10038 |

||

|

Investor & K-1 Services: |

855-4AT-AXK1 |

|

|

Phone: 718-921-8124 |

|

|

Web Site: |

www.ataxfund.com |

|

|

888-991-9902 |

|

|

K-1 Services Email: |

k1s@ataxfund.com |

|

|

|

|

|

Ticker Symbol: |

ATAX |

|

|

|

|

|

Corporate Counsel: |

|

Independent Accountants: |

|

Barnes & Thornburg LLP |

|

PwC |

|

11 S. Meridian Street |

|

1 North Wacker Drive |

|

Indianapolis, IN 46204 |

|

Chicago, Illinois 60606 |

|

|

|

|

|

Board of Managers of Greystone AF Manager, LLC: |

||

|

(acting as the directors of ATAX) |

||

|

|

|

|

|

Stephen Rosenberg |

|

Chairman of the Board |

|

Curtis A. Pollock |

|

Manager |

|

Jeffrey M. Baevsky |

|

Manager |

|

Drew C. Fletcher |

|

Manager |

|

Steven C. Lilly |

|

Manager |

|

Walter K. Griffith |

|

Manager |

|

William P. Mando, Jr. |

|

Manager |

|

|

|

|

|

Corporate Officers: |

||

|

Chief Executive Officer – Chad L. Daffer |

||

|

Chief Financial Officer – Jesse A. Coury |

||

|

Chief Investment Officer - Kenneth C. Rogozinski |

||

|

|

13 |

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS, L.P.

CASH AVAILABLE FOR DISTRIBUTION (CAD) AND OTHER PERFORMANCE MEASURES

The following table contains reconciliations of the Partnership’s GAAP net income (loss) to its CAD:

|

|

For the Three |

|

|

For the Nine |

|

||

|

|

Months Ended |

|

|

Months Ended |

|

||

|

|

September 30, 2020 |

|

|

September 30, 2020 |

|

||

|

Partnership net income (loss) |

$ |

(1,160,017 |

) |

|

$ |

6,410,088 |

|

|

Change in fair value of derivatives and interest rate derivative amortization |

|

14,569 |

|

|

|

(104,279 |

) |

|

Depreciation and amortization expense |

|

719,783 |

|

|

|

2,141,302 |

|

|

Provision for credit loss |

|

3,463,253 |

|

|

|

5,285,609 |

|

|

Provision for loan loss |

|

811,706 |

|

|

|

811,706 |

|

|

Reversal of impairment on securities |

|

- |

|

|

|

(1,902,979 |

) |

|

Impairment charge on real estate assets |

|

- |

|

|

|

25,200 |

|

|

Amortization of deferred financing costs |

|

497,018 |

|

|

|

1,288,044 |

|

|

Restricted units compensation expense |

|

299,524 |

|

|

|

634,860 |

|

|

Deferred income taxes |

|

(34,601 |

) |

|

|

(66,482 |

) |

|

Redeemable Series A Preferred Unit distribution and accretion |

|

(717,763 |

) |

|

|

(2,153,288 |

) |

|

Tier 2 Income distributable (Loss allocable) to the General Partner |

|

- |

|

|

|

80,501 |

|

|

Bond purchase premium (discount) amortization (accretion), net of cash received |

|

(20,389 |

) |

|

|

(39,956 |

) |

|

Total CAD |

$ |

3,873,083 |

|

|

$ |

12,410,326 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of BUCs outstanding, basic |

|

60,545,204 |

|

|

|

60,614,862 |

|

|

|

|

|

|

|

|

|

|

|

Partnership Only: |

|

|

|

|

|

|

|

|

Net income (loss) per BUC, basic |

$ |

(0.03 |

) |

|

$ |

0.07 |

|

|

Total CAD per BUC, basic |

$ |

0.06 |

|

|

$ |

0.20 |

|

|

Distributions declared per BUC |

$ |

0.060 |

|

|

$ |

0.245 |

|

|

|

14 |

|

|

|

|

AMERICA FIRST MULTIFAMILY INVESTORS, L.P.

TAX INCOME INFORMATION RELATED TO BENEFICIAL UNIT CERTIFICATES

The following table summarizes tax-exempt and taxable income as percentages of total income allocated to the Partnership’s BUCs on Schedule K-1 for tax years 2017 to 2019. This disclosure relates only to income allocated to the Partnership’s BUCs and does not consider an individual unitholder’s basis in the BUCs or potential return of capital as such matters are dependent on the individual unitholders’ specific tax circumstances.

|

|

2019 |

|

2018 |

|

2017 |

|

Tax-exempt income |

37% |

|

41% |

|

62% |

|

Taxable income |

63% |

|

59% |

|

38% |

|

|

100% |

|

100% |

|

100% |

|

|

|

|

|

|

|

|

|

15 |